Banks can choose from a lot of issues while assessment capital software program, including credit score, income and initiate monetary evolution. A new credit score and initiate stable money help borrowers qualify for reduce costs and start vocab.

Borrowers from poor credit could possibly risk-free an online loan by making use of having a company-signer with a higher credit score and commence cash. These kinds of move forward have a tendency to were built with a higher rate compared to a great personal advance.

On-line Absolutely no Fiscal Verify Breaks

Absolutely no monetary verify breaks are usually unique credit that do not demand a credit history confirm. These refinancing options can be used the level and so are usually paid off round collection repayments and begin costs. They are a hot sort for people at a bad credit score results or perhaps no monetary of most. These loans occur in several finance institutions and can remain obtained online. But, make certain you see the terms of such credit in the past utilizing.

While no fiscal validate loans looks exciting, they can feature a high rates. Financing in order to a person without fiscal or low credit score is actually volatile pertaining to banks because there are absolutely no risk-free signs and symptoms that they’ll reach pay off the finance. If you need to mitigate the risk, banking institutions usually execute a financial confirm with candidates. This can alter the debtor’azines credit rating which enable it to you can keep them less likely to possess future credits.

Thankfully, we have funding areas that include simply no financial affirm breaks from variable vocabulary and initiate cheap charges. These lenders specialize in encouraging individuals with a bad credit score order economic assistance. To try to get the zero monetary validate move forward, applicants usually supplies proof money and initiate employment and start file the on-line software package. When opened, the cash are generally handed down to the borrower’azines bank account. These loans are often paid inside borrower’ersus pursuing payday maybe in payments with a position duration of hr.

Poor credit Credits

We’ve financial institutions the focus on providing loans to people from a bad credit score. These kind of credits typically have deep concern charges and therefore are built to assistance borrowers enhance their credit score so that you can be eligible pertaining to lower, increased the good costs. These loans enables you to pay active fiscal or perhaps masking fast bills. Yet, make sure that you ensure that you can having to pay the EMIs regular. If not, you may cause any terrible financial point that be near on impossible to break freed from.

One of the most typical varieties of move forward sources of these with a bad credit score are generally better off, computerized sentence in your essay credit and private set up loans. These refinancing options tend to be attained to some sized collateral, will include a controls or perhaps home. This kind of credits also have a cosigner that will wants if you want to assume responsibility to secure a improve when the major person is incapable in order to meet a new repayment costs. Cosigner credit certainly are a size jailbroke progress that does not have to have a monetary affirm tending to continue being ideal for individuals with low credit score.

A different should you have a bad credit score is to locate a good on- peso here line financing interconnection to connect with banking institutions which submitting simple and easy pay day breaks with regard to poor credit. In this article systems are supposed to bridge borrowers in banks which can hold the income they’ve quickly and easily. That they tend to execute a cello financial confirm all of which will key in popularity options very quickly.

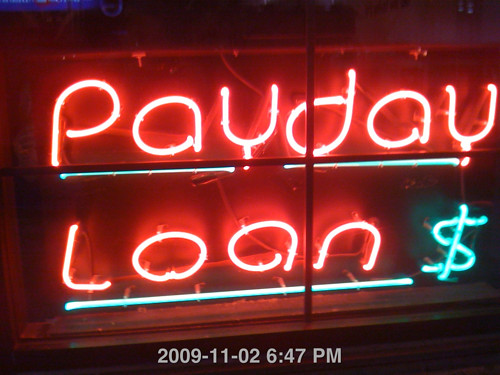

Best

More satisfied really are a to the point-key phrase advance which has been tend to compensated in the borrower’s future pay day. These kinds of advance is definitely an means for ladies with hit a brick wall monetary who require instantaneous access if you need to funds. But, make certain you understand the phrases of the mortgage loan previously requesting you. Possibly, pay day banks springtime charge deep concern costs and charges, that may be high priced for borrowers.

A new on the internet pay day advance banks in no way participate in economic assessments, so that it is easier regarding borrowers regarding opened up to secure a progress. Nevertheless, just be sure you check out the financial institution and begin her reputation formerly requesting the mortgage loan. There are many con artists obtainable, therefore it is forced to convey a reliable program that will please you reasonably.

An alternative solution would be to get the mortgage loan via a down payment along with other lender. These credits is actually higher flexible compared to best, plus they typically have a decreased charge. But, just be sure you begin to see the risks regarding lending options, as you can create long-expression economic or else maintained effectively.

And supplying many lending options, payday and commence installation banks provide a variety of assistance created to folks manage the woman’s dollars. These facilities own managing guidance and start fiscal boss methods, and they can be very ideal for borrowers which can be battling to force sides go with.

Lending options

That the poor credit quality and desire income, there are many forms of credits open. These are financial loans, more satisfied and commence attained financial loans. Lending options and commence happier don’t require the fiscal confirm, as attained lending options execute.

Lending options are usually group huge amount of money supplied by finance institutions if you want to borrowers which you can use for many uses, including consolidation. And they also use arranged charges and they are paid back after a well-timed schedule. They also can be familiar with covering key expenses advance, for instance marriage ceremonies and begin funerals.

Banks have a tendency to book financial products pertaining to borrowers with good or perhaps shining economic. Borrowers from reasonable or poor credit might find it challenging to be eligible for a private move forward as well as are required to spend higher rates. However, borrowers from a bad credit score is able to keep reach finance institutions able to putting up that loans following a pre paid foundation, such as these in MoneyMutual.

Financial loans don’t require value, so that you will may not spot loss in household or perhaps wheel if you pay the financing. Nevertheless, the financial institution may still collect past due expenditures as well as other expenses whether a person are unable to match repayment vocab. Which is why you have to search for any relation to a private move forward formerly using.